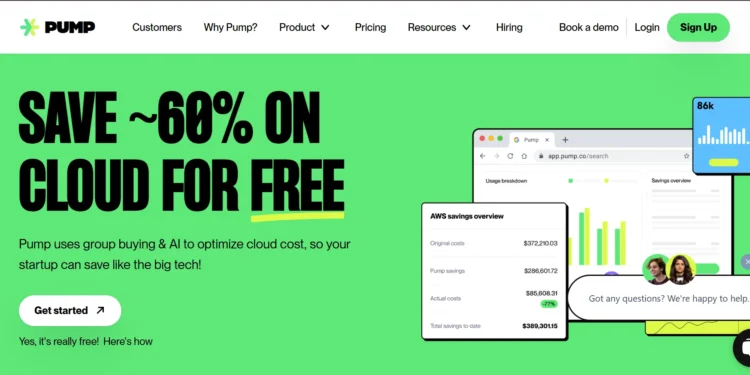

In a funding climate where every month of runway counts, early-stage start-up Pump is offering founders an automated lifeline: cloud-infrastructure savings without a single line of code.

The YC-backed company, featured this week by Canadian tech outlet BetaKit, has rolled out a FinOps platform that it says reduces bills by 20 to 60 per cent across AWS, Azure and Google Cloud. The software pools demand from thousands of users—group buying for compute—and applies volume discounts automatically.

Pump reports that more than 1000 start-ups have signed up since launch, most of them post pre-seed ventures trying to stretch tight burn rates. Large tech firms can field finance engineers to fine-tune usage; smaller companies rarely have that bandwidth, and Pump aims to close the gap.

Why FinOps Matters in 2025

In 2024 founders chased growth; in 2025 they chase efficiency. Investors now reward teams that prove financial discipline as early as product-market fit.

Pump’s approach is simple: the platform buys large-scale commitments from the big three clouds, then redistributes savings to users. No contracts, no code and no long onboarding. In the company’s words, savings vary “in the 20 to 60 per cent range depending on usage profile”.

Demand for plug-and-play FinOps is rising as AI workloads, multi-cloud complexity and higher list prices threaten to erode runway. Even minor billing errors can burn months of cash.

Signals for Founders and Investors

- Adoption pace – Rapid user growth will show whether founders value outsourced cost control as much as outsourced payroll or security.

- Adjacent automation – Success could spur similar no-code models in compliance, DevOps and cloud security.

- VC sentiment – Capital may tilt towards tools that extend runway rather than pure-play growth hacks.

Pump’s momentum suggests a broader movement towards founder-first infrastructure: practical software that saves money today and scales quietly in the background. For start-ups fighting to survive long enough to thrive, cost-cutting may be the new killer feature.