In a game-changing move that signals the growing global ambition of African immigrant-led ventures, Toronto-based cross-border fintech Pesa has announced its acquisition of Authoripay, a UK electronic money institution with full Financial Conduct Authority licensing. The deal secures Pesa’s entry into the European financial system and marks a defining moment in Canada’s fintech export story.

The acquisition gives Pesa direct access to a robust suite of FCA permissions, including money remittance, e-money issuance, payment initiation, and virtual IBAN services. This positions the company to operate with the regulatory firepower of a major financial institution in the UK and EU.

The UK entity has already been rebranded as Pesapeer Payments UK and is expected to add over 80 million dollars in annualised transactional volume to Pesa’s infrastructure. But the real crown jewel in this acquisition is the transfer of Mastercard Principal Membership. This enables Pesa to issue and acquire cards globally under its brand.

A Blueprint for African Innovation on Canadian Soil

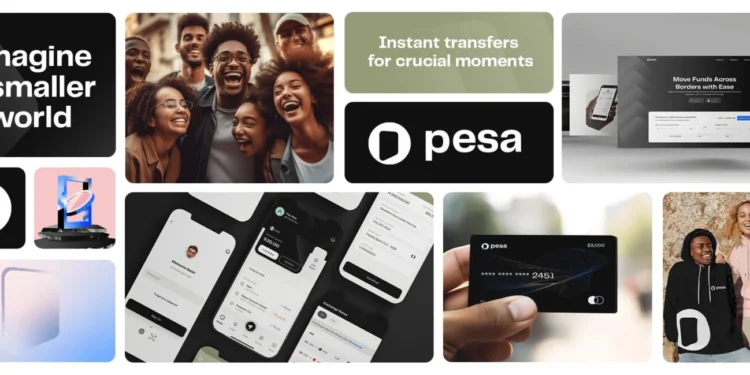

Pesa was founded in 2021 by Nigerian Canadian immigrants Tolu Osho, Yusuf Yakubu, and Adewale Afolabi. It has rapidly scaled into one of the most talked-about new players in global fintech. With over 380 million dollars in processed volume across four continents and a profitability milestone reached within its first two years, Pesa represents a new kind of Canadian fintech that is borderless in vision, pan African in spirit, and global in execution.

The startup already offers a robust suite of multi-currency wallets, business treasury tools, and cross-border payment solutions. With this acquisition, it adds a regulatory passport to Europe, creating a new advantage for businesses and diaspora communities navigating complex international transactions.

This acquisition is not just strategic, it is foundational,” said Tolu Osho, CEO of Pesa. “We are now licensed to operate across major jurisdictions with the capacity to issue global cards. That means we can deliver a unified platform to the millions of people and businesses underserved by traditional financial systems.

Immigrant-led innovation

For African founders in the diaspora, the signal is clear. It is possible to build globally relevant fintech infrastructure from the ground up, acquire the right licenses, and enter mature markets on their terms. Pesa’s move follows recent landmark activity by African-led fintechs like Moove and LemFi and confirms that Toronto is becoming a strategic launchpad for cross-continent financial innovation.

By acquiring Authoripay, Pesa has

- Secured a full FCA license suite

- Gained the right to issue Mastercard-branded debit and prepaid cards

- Acquired infrastructure to support European market compliance and onboarding

- Added scale to its global payments engine

- Strengthened its market position across Canada, Europe, Africa, and Asia

A Canadian African Fintech Powerhouse

What started as a vision to simplify cross-border finance for migrants is now evolving into a financial infrastructure layer connecting North America, Africa, Europe, and beyond. Pesa is now building at the intersection of remittance, digital banking, and regulatory arbitrage with the agility of a startup and the reach of a multinational.

This latest deal confirms one thing. African-led innovation in Canada is not waiting for permission. It is buying the licence.